carried interest tax proposal

1 lengthens the time period investment funds must hold assets to five years. Last month the House Ways and Means Committee marked up the Build Back Better Act to include a provision modifying how carried interest is treated under the tax code.

The Tax Treatment Of Carried Interest Aaf

This Alert summarizes some of the proposals that may be relevant to private investment funds.

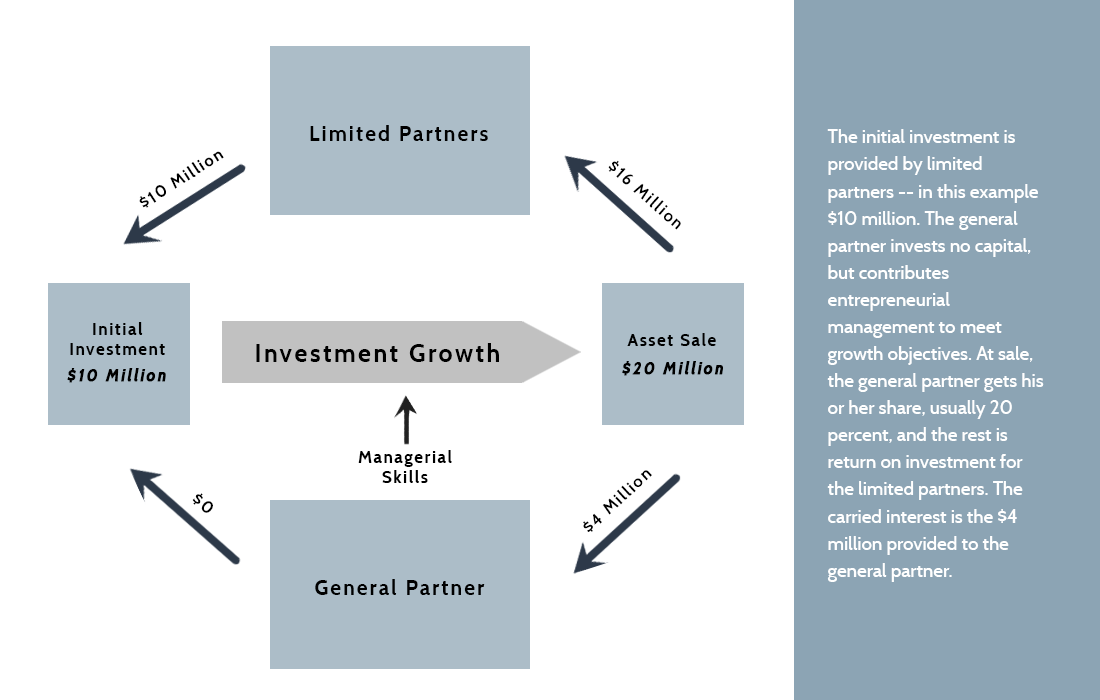

. Federal income tax treatment of partnership interests issued in exchange for services commonly known as carried interests. On January 7 2021 the Department of the Treasury and the IRS issued final regulations under Section 1061 of the Internal Revenue Code regarding the taxation of carried interests. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. Benefits of the Carried Interest Legislative proposals to reduce or eliminate the tax benefits of the Carried Interest have failed on several occasions in the last 10 years including in 2017 3 year holding period rather than 1 year to obtain long-term capital gain treatment Holding period applies to sale of Carried Interest. 14 Sep 2021 0.

The proposed Ending the Carried Interest Loophole Act S. Carried Interest Tax Proposal Threatens Charitable Giving. Carried Interest Raises 141 billion.

These rules make some notable and mostly taxpayer-friendly changes to regulations proposed in July 2020. The most recent attempt to address carried interest was in 2017 under then-President Donald Trump. The Congressional Budget Office has estimated that taxing carried interest as ordinary income would raise 14 billion over a decade.

Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. The Ways and Means Committee in an informal estimate claims the same amount of savings from its proposed change. However carried interest attributable to a real property trade or business would retain a three-year holding period requirement.

Increases and Decreases in Corporate Tax Rate. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration. Some view this tax preference as an unfair market-distorting loophole.

The typical carried interest amount is 20 for private equity and hedge funds. Carried interest is very generally a share of the profits in a partnership paid to its manager. The bill contains some anticipated proposals as well as a few surprises of particular interest to Private Equity funds.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats. It would also extend the carried-interest rules to all assets eligible for long-term capital gains rates.

But in reality the tax as proposed in the administrations plan would impact partnerships of all sizes including those with. Maryland proposes tax on carry management fees. Corporations with net income up to 5 million would be taxed at 21 percent.

A new proposal to tax carried interest as ordinary income was just attached to a larger tax and spending bill that could be voted on by the House as early as tomorrow. Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses.

The proposal which is part of a 35 trillion tax and spending package that House leaders say could get a vote by Oct. On September 13 2021 the House of Representative Ways and Means Committee introduced tax proposals that if enacted would make significant changes to the US. The Ways and Means Committee has proposed replacing the flat corporate income tax with a progressive rate structure.

1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate. The proposed changes to the carried interest rules in section 1061 could significantly limit favorable tax treatment of carried interests for high-earner PEVC professionals. House Ways and Means Committee Chairman Richard Neal on Monday proposed a major set of tax hikes to fund Democratic President Joe Bidens social spending plans one tax break popular among major Democratic Party donors was left in placethe taxation of carried interest income at the lower capital gains rate.

The proposal would generally extend the three-year holding period required for carried interest to be taxed as a capital gain as opposed to ordinary income to five years. The proposed carried-interest change would include some exceptions retaining the three-year holding period for real property trades or businesses and taxpayers earning less than 400000. The top rate would increase to 265 percent for corporations with net incomes exceeding 5 million.

The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest as a perk for private equity. On August 5 2021 Senate Finance Committee Chairman Ron Wyden and Senator Sheldon Whitehouse introduced proposed legislation the Ending the Carried Interest Loophole Act or the Proposal that would substantially change the US. Notable examples of private equity funds that charge.

Federal income tax system.

Filofax Love Read O3 28 13 Cute Read About Her Love For Filofax Tht Filofax Planners Filofax Moleskine Planner

All Strange And Wonderful How To Plan Tax Haven Bernie

9 Project Initiation Document Templates Word Excel Pdf Templates Document Templates Word Template Project Proposal Template

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Posts Distort Impact Of Biden S Tax Plan On Middle Income Earners Income Payroll Taxes Corporate Tax Rate

Biden Tax Plan And 2020 Year End Planning Opportunities

Sample Grant Proposal For After School Program Fresh 3 Letter Of Support For Project Proposal After School Program Grant Proposal Support Letter

Free Course Proposal Template Business Plan Template Free Proposal Templates Free Proposal Template

Collaboration Tools Which Boost Stakeholder Engagement Engagement Strategies Business Management Degree Business Management

The Iom Has Undertaken Two Studies On Remittances In Ghana A Baseline Assessment Of Household Remittances Over A 12 Mo Household Income Economic Trends Ghana

Business Proposal 555 Business Proposal Writing A Business Proposal Proposal

Financial Management Software In Uae Zielgruppenanalyse Marketing Strategie Suchmaschinenoptimierung

Hong Kong Profits Tax Exemption To Be Extended To Offshore Private Equity Funds 2015 Private Equity Equity Offshore

Start Your Commercial And Professional Business Dubai Business Business Advisor Dubai

Safety Blog Policy Template Small Business Organization Personal Protective Equipment

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Carry Income Tax Tax Deductions Income